You are not allowed to make money!

/OK, so after many years of hard work you finally have a profitable business trading and quoting on exchange. Obviously the success you have in quoting attracts attention and exchanges come knocking asking if you would like to quote a new future on their exchange. Point is, it's new, so illiquid and furthermore, there is nobody else quoting it.

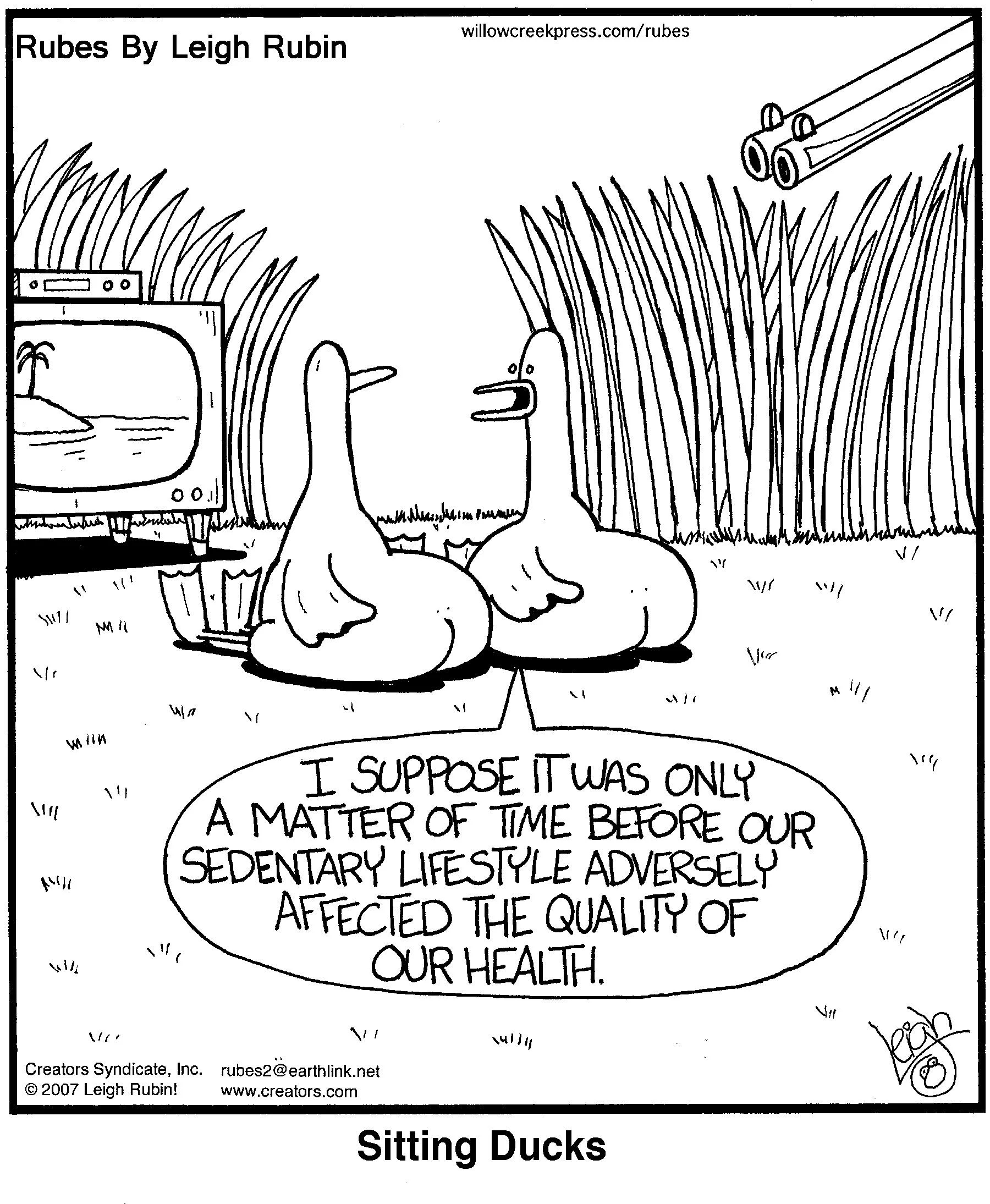

You start wondering: at what price do I want to be a sitting duck and make no money trading? Any straight forward thinking person will consider two options. 1. I don't do it or 2. I do it but then I want to get paid. The exchange will happily pay you to quote and will set risk parameters in concert with you.

This is where in the future things might get tricky. The CFTC is looking at setting rules on how these incentive programs of exchanges can be restricted. In Europe MIFID II will set rules on what market makers are obliged to do. So basically they are saying: you're making enough money on the liquid stuff so there is no problem if you lose money on illiquid stuff.

Nobody will do this. Nobody wants to put time and money into something that does not pay off and nobody wants to be a sitting duck.

I'm sometimes amazed at what regulators and politicians can come up with. It looks like they are missing a basic understanding of how markets work. In their desire to regulate financial markets after the crisis they have now started to over-regulate. However, in their view they are not over-regulating, they are just reducing risk!

Reducing risk was certainly very important after the financial crisis. Banks, brokers, exchanges, regulators, policy makers,... all of them were to some extent not aware of what the risks were. The problem is that regulation can also destroy an industry.